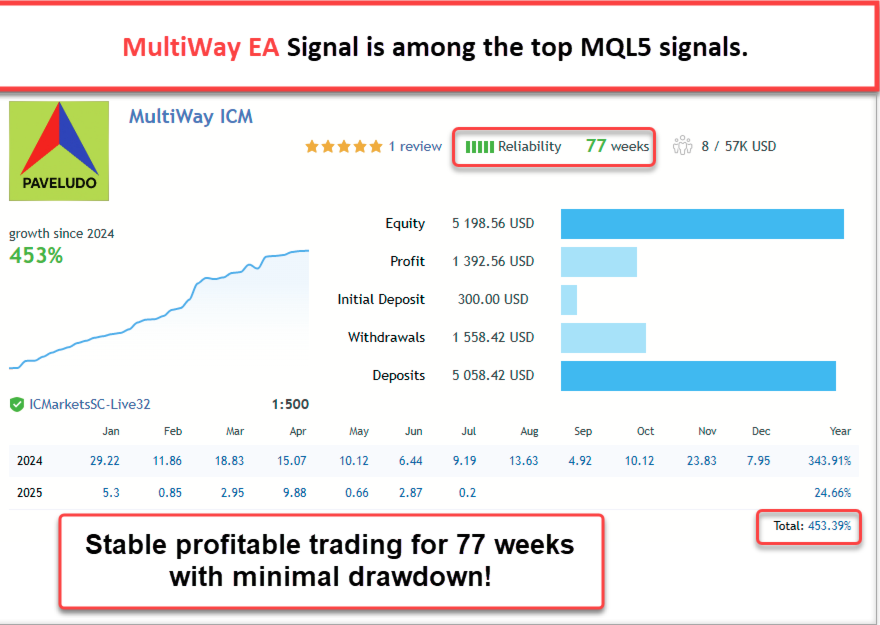

MultiWay EA — Diversified Mean-Reversion for 9 FX Pairs, Prop-Friendly Controls (MT5)

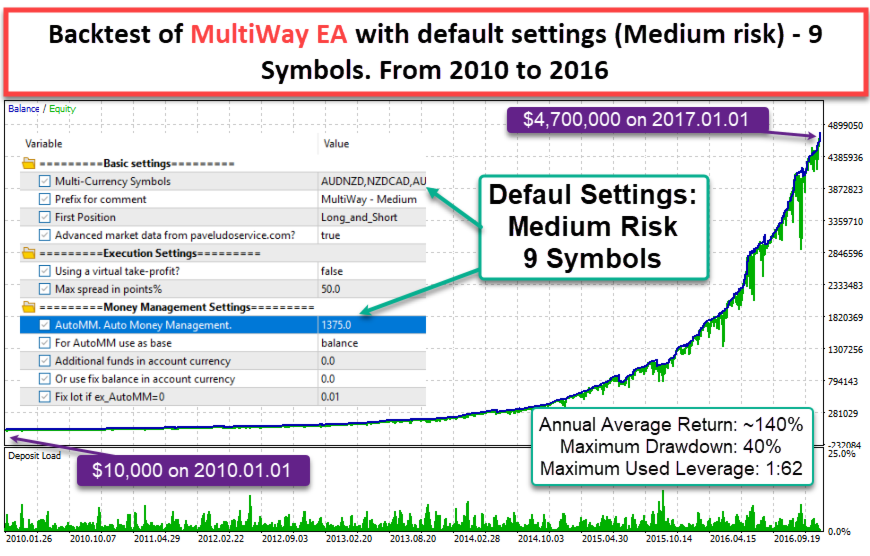

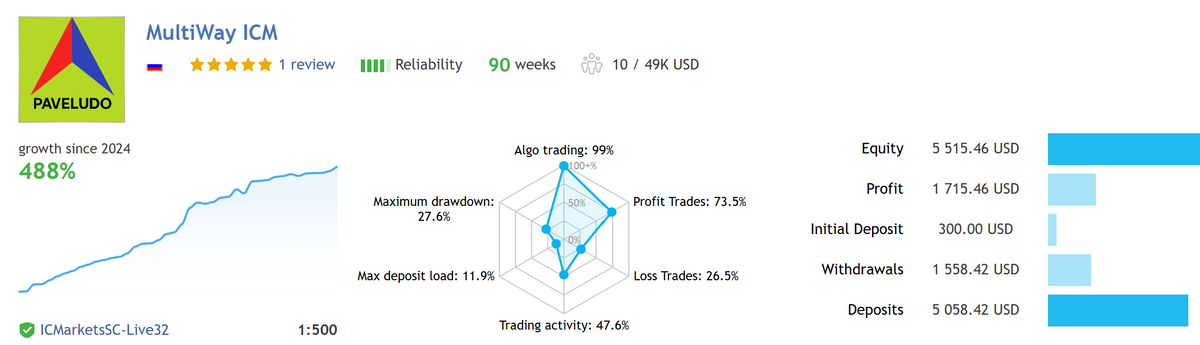

MultiWay EA is a portfolio Expert Advisor built around a robust mean-reversion core. It spreads risk across nine correlated majors/minors to capture pullbacks after strong impulses—favoring quality entries and controlled exposure over noise. No martingale, no grid. Designed for clean execution on ECN/RAW accounts.

🔑 Key Features

Mean-Reversion Engine – Targets price reversion after directional bursts.

9-Pair Diversification – AUDNZD, NZDCAD, AUDCAD, USDCAD, EURUSD, GBPUSD, EURCAD, EURGBP, GBPCAD.

Portfolio Logic – Distributes opportunities across a basket instead of one symbol (reduces single-pair risk).

Clean Risk Workflow – Fixed SL/TP approach with configurable trade frequency (per author guidance).

One-Chart Simplicity – Attach EA, load the provided set files, choose risk—done.

📈 How It Trades

Identifies overextended moves and seeks a controlled reversion toward the average.

Signals favor correlated pairs to improve the number of quality setups while limiting concentration.

Typical pace: selective entries; frequency varies with market volatility.

⚙️ Recommended Setup

Platform: MetaTrader 5 (MT5) • Account: ECN/RAW spreads recommended.

Leverage: ~1:100+ as commonly advised for the author’s systems.

Capital: Author’s signal guidance suggests $3,000+ for comfortable operation (adjust per risk).

🎛️ Key Inputs

Risk per trade or per symbol, SL/TP controls, and frequency settings (use the vendor’s set files & guide after purchase).

🆕 Version & Notes

Current listing shows v1.11 with recent updates and active maintenance on the Market page.

📦 What’s Included

MultiWay EA (MT5), setup instructions, and portfolio set files from the vendor after purchase.

Pro Tips

Start conservative across a smaller basket, then scale pairs/risk as fills and slippage validate on your broker.

Keep costs tight (spread/commission) to preserve mean-reversion edge—ECN/RAW feeds matter.

❓ FAQ

Does it use martingale or grid?

The strategy emphasizes mean-reversion with controlled risk, not martingale or grid escalation.

Can I run all nine pairs at once?

Yes—diversification is the intent; allocate risk per symbol and ensure margin headroom.

⚠️ Risk Warning

Trading FX/CFDs involves significant risk. Even robust, diversified strategies can lose money. Test on demo first and size positions responsibly.