The Scalping Project EA

Strategy: A fast scalping-breakout system that places stop orders at relative highs/lows and secures gains with an adjustable trailing stop. It does not use martingale or grid.

Best with low trading costs. Because average profit per trade is small, use a low-spread, low-commission broker for best results

Why traders use it

-

True breakout logic – waits for price to breach recent highs/lows and enters with stop orders for quick execution.

-

Risk first – fixed SL for every trade; optional drawdown guard to flatten positions at a user-set threshold.

-

Hands-off management – configurable trailing stop (trigger, distance, and step) to lock profits automatically.

-

No grid / no martingale – linear risk that’s easy to size and audit.

-

Time control – trade only during your preferred market hours, avoid sessions you don’t want.

Key Features

-

Breakout entries from algorithmic highs/lows (sensitivity adjustable)

-

Buy/Sell toggles (run long-only, short-only, or both)

-

Position sizing by fixed lot or % risk of balance

-

Fully configurable TP/SL/TSL (trigger, distance, and step)

-

Time filter (start/end time) for when new orders may be placed

-

Max daily drawdown % auto-close protection (equity/balance based)

-

Clear order comments, unique magic number, and optional on-chart status

Inputs at a glance

Trading Direction

-

Buy Trades / Sell Trades – enable/disable long and short entries

Signal Logic

-

Timeframe – candle TF used to detect highs/lows

-

BarsN – swing sensitivity (smaller = more swings; larger = fewer, stronger swings)

Risk & Targets

-

Trading Volume – Fixed Lots or % Risk of Balance

-

Fixed Lots – lot size if using fixed mode

-

Risk % of Balance – risk per trade if using % mode

-

TP Points / SL Points – distance from entry to target and stop

-

TSL Trigger – profit distance before the trailing stop activates

-

TSL Points – trailing distance behind price

-

TSL Step – minimum improvement before SL is moved

Session Control

-

Time Filter – on/off

-

Start Hour/Minute & End Hour/Minute – allowed order window

Protection

-

Drawdown Monitoring – on/off

-

Max Daily Drawdown % – closes all EA trades if exceeded

Misc

-

Order Comment – text applied to each order

-

Magic Number – must be unique per EA/chart

-

Chart Comment – on/off display panel

Best Practices

-

Use a RAW/ECN account with tight spreads and low commissions.

-

Run on a reliable VPS close to your broker for fast stop-order execution.

-

Start with conservative risk (the author’s 5%/trade tests are not low risk).

-

Forward-test and tune BarsN, TP/SL, and TSL for your broker’s costs and symbol behavior.

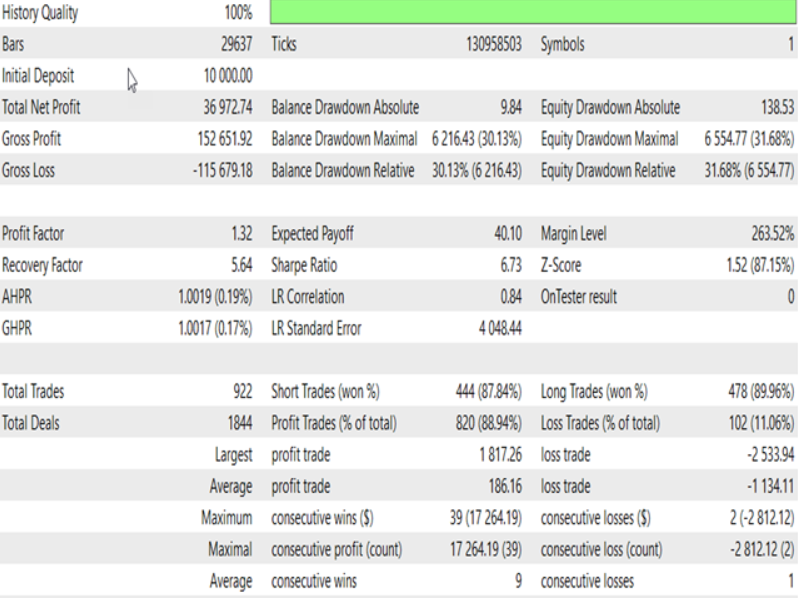

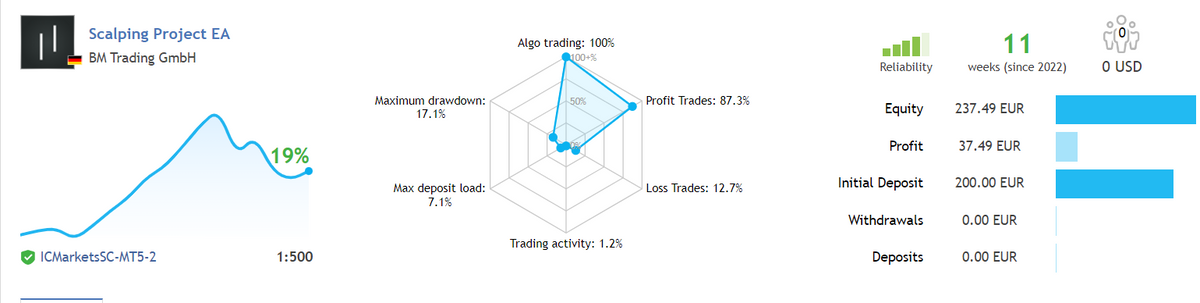

Notes on Backtests

Screenshots use default settings; depending on broker conditions and parameters your results may differ. Always validate with the free demo and your own tests before going live.

Risk Disclosure

Trading leveraged products involves substantial risk. Past performance (including backtests and signals) does not guarantee future results. Only trade with money you can afford to lose.